What Is Net Profit and How Do You Calculate It?

A Simple Guide for Business Owners and Beginners

Understanding net net income is one of the most important aspects of managing a business or even systematic planning of your unique funds. If you run a small shop, a growing startup, or want to know how companies measure success, net income gives you a clear idea of how much money is actually being produced.

Citizens, primarily looking at gross sales, assume that an industry with a high turnover is growing involuntarily. Despite that income, they never give a complete account of it. That’s about who’s going to stay in your pocket next and cover all expenses. That number shall be called net net income.

In this guide, we will break down the concept of depression, how to calculate net income, why it is a problem, and how understanding it can help you make better financial resolutions. Additionally, we will explore how instantaneous loans, private loans, and loans with a 2-minute approval process can support enterprises struggling with low net income or sudden cash flow requirements.

What Is Net Profit?

The net income shall be the cash left after the deduction of the total costs of the undertaking from the total earnings. This will show whether the firm actually earns money, or whether it only generates gross sales that do not produce any significant tax rebate.

Assuming that takings are the money that comes in, net income is the money that stays in the firm for the next payment.

- Rent

- Salaries

- Raw materials

- Electricity

- Taxes

- Loan EMIs

- Marketing

- Maintenance

And any other expense required to run operations

In short:

Net Profit = Total Revenue – Total Expenses

If your trade is suitable, the current closing quantities are displayed. A company may earn crores of revenue and still have otherwise unfavourable net income, provided the expenditure is excessively high.

Why Is Net Profit Important?

It shows true business performance

Revenue can look impressive, but net profit reveals the actual success of the business.

Helps in planning and budgeting

You cannot plan wages, growth, or stakes unless you know how much net income you actually create.

Useful for investors and lenders

To assess your firmness, lenders, NBFCs, and even lenders offering instantaneous loans, or otherwise instantaneous private loans, check your net income patterns.

Helps you identify cost problems

If your net profit is shrinking, it means expenses are growing faster than revenue.

Essential for valuation

If you’re eternally committed to selling or expanding your business, the net profit will be a significant factor in the evaluation.

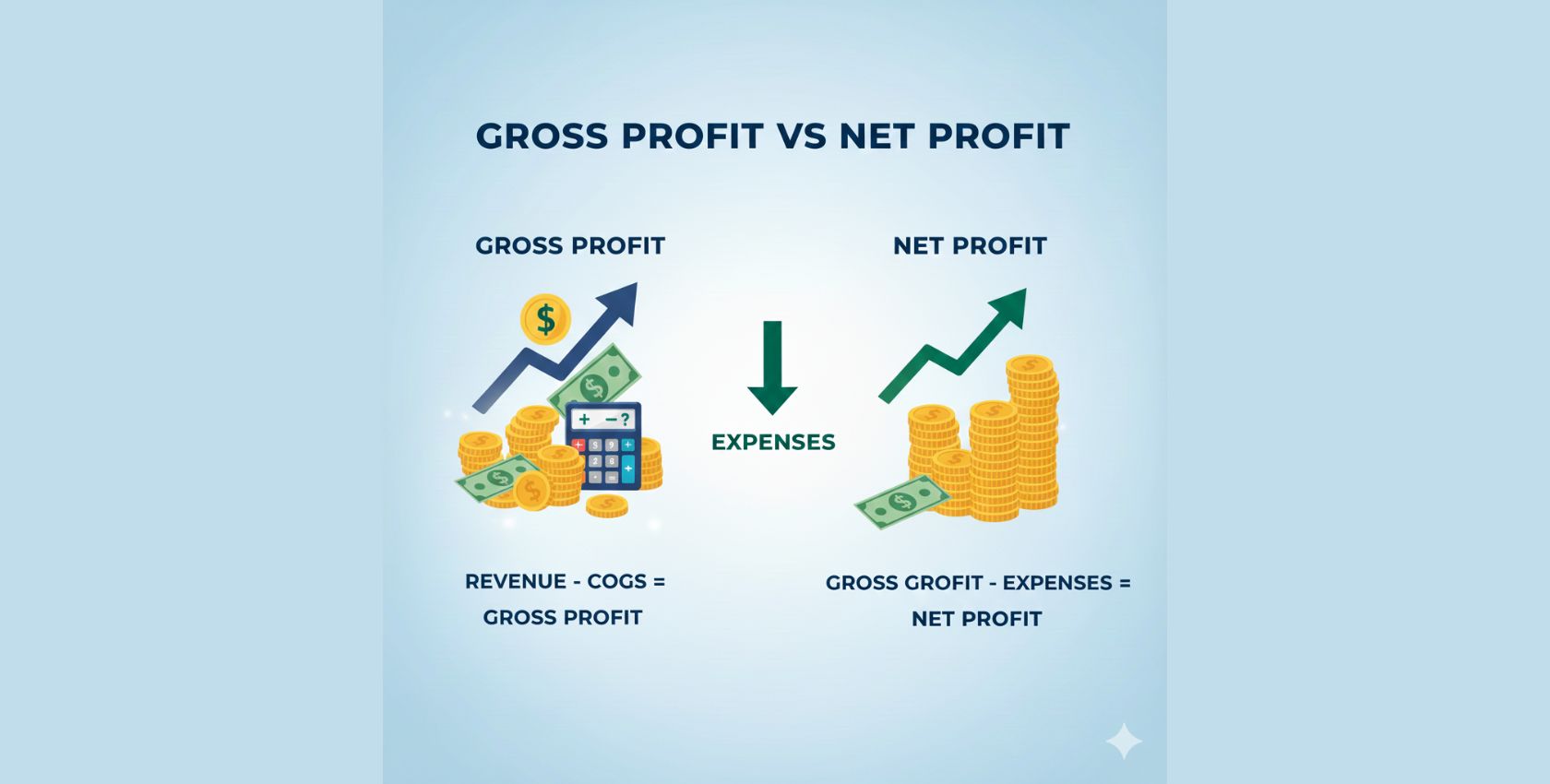

Gross Profit vs Net Profit

Many people confuse net profit with gross profit. They are very different.

- Gross Profit = Revenue – Cost of Goods Sold (COGS)

This only covers the cost of producing goods or services.

- Net Profit = Gross Profit – All Other Expenses

This includes overheads, admin costs, salaries, utilities, taxes, and more.

Imagine that the primary filter is gross net income, and the final, true total is net net income.

How to Calculate Net Profit: Step-by-Step

Let’s go through a simple example.

Step 1: Calculate Total Revenue

Example:

A shop sells products worth ₹5,00,000 in one month.

Step 2: Calculate Total Expenses

Expenses might include:

- Rent: ₹20,000

- Salaries: ₹1,50,000

- Raw material cost: ₹2,00,000

- Electricity: ₹8,000

- Marketing: ₹10,000

- Transportation: ₹12,000

- Taxes: ₹20,000

Total Expenses = ₹4,20,000

Step 3: Apply the Net Profit Formula

- Net Profit = Total Revenue – Total Expenses

Net Profit = ₹5,00,000 – ₹4,20,000

- Net Profit = ₹80,000

This means that after all expenses, the business actually earns ₹80,000 in profit.

Common Mistakes While Calculating Net Profit

- Ignoring hidden costs

Things like software subscriptions, small repairs, or packaging expenses add up.

- Not tracking depreciation

Assets lose value over time. Ignoring this gives a wrong profit figure.

- Mixing personal and business expenses

This is a common issue for small businesses and makes profit calculation inaccurate.

- Only relying on revenue growth

Growing sales don’t always mean growing profit.

How Net Profit Impacts Your Financial Decisions

The greater your net income is, the more flexible your business becomes. You’ll be able to share information faster, recruit more people, invest in branding, or upgrade your equipment. The reduction in the net income limit may lead to cash current problems.

Many small businesses face issues like:

- Delayed customer payments

- Seasonal sales

- High operational costs

- Sudden emergencies

In the same way as in the scenarios, the net income may not be sufficient for the running of daily operations. In the present situation, fiscal solutions appreciate instantaneous loans, instantaneous unique lending, or even advances in two-minute aid.

How Instant Loans Support Low-Profit Businesses

A company with minimal or inconsistent net income can compete with liquid assets. While net income demonstrates long-term performance, cash flows present a daily financial power.

If cash flow is tight, the business may benefit from:

- Working capital top-up

Instant loans help maintain day-to-day operations without disrupting business.

- Managing urgent expenses

Sometimes urgent payments can’t wait, and loans in 2 minutes offer a quick solution.

- Stocking inventory during demand surges

Seasonal businesses use instant loans to take advantage of high-demand periods.

- Handling gaps between customer payments

Late payments often hurt net profit and working capital.

The instantaneous lending of human capital, as well as emergency loans, helps enterprises to remain secure even when their net income is temporarily reduced.

Ways to Increase Net Profit

Here are practical methods that work across industries:

- Increase prices carefully

If you provide quality, customers will accept slightly higher pricing.

- Reduce unnecessary expenses

Audit your spending every month.

- Boost sales through targeted marketing

Digital ads can bring more clients without high costs.

- Improve customer retention

Repeat customers increase revenue without extra marketing costs.

- Control inventory

Avoid overstocking items that don’t sell often.

- Automate operations

Simple tools for billing, accounting, and marketing can save both time and money.

Net Profit Margin: Another Key Metric

Net profit margin shows how much profit you earn per rupee of revenue.

Formula:

Net Profit Margin = (Net Profit / Revenue) × 100

- If your net profit is ₹80,000 and revenue is ₹5,00,000:

- Net Profit Margin = (80,000 / 5,00,000) × 100

- Net Profit Margin = 16%

A higher margin means better financial efficiency.

How Knowing Net Profit Helps You Apply for a Loan

In the case of instantaneous lending, instantaneous private loans, or loans within two minutes, the lender normally checks.

- Your profit history

- Your ability to repay

- Your cash flow

- Your business stability

If you maintain strong net profit records, the approval process becomes smooth and fast.

Net Profit and Tax Planning

A clear understanding of net net income supports and improves tax administration. Companies frequently reduce their legal tax bill by dividing it.

- Machinery

- Software

- Insurance

- Depreciable assets

Maintaining the correct documents is not only a boost to profitability but also helps when using loans as an alternative to preparing a tax return.

Final Thoughts

The clear indicator of the financial well-being of a business is its net income. It tells you if you’re actually making money or just traveling with cash in and out. You’ll be able to make intelligent choices, reduce uneconomic spending, and build a strong financial base by studying how to calculate it.

Financial instruments such as instantaneous lending, instantaneous personal loans, and advances of two minutes may be of assistance to companies facing cash flow interruption or sudden expenditure. In order to optimize this, however, the sustained target should always remain. Maintain a stable economic system by maintaining your net income.

Understanding net net income, International Relations and Security Network, thymine complicates. All that is needed is uniform monitoring, smart spending, and clear financial habits.

FAQs

- What is net profit in simple words?

The net profit is the amount of cash left after deduction of all the company expenses from the total amount of your earnings. This shows your company’s actual net profits.

- How do I calculate net profit for my business?

Use this formula:

Net Profit = Total Revenue – Total Expenses

Include all costs such as salaries, rent, materials, taxes, utilities, and loan payments.

- Why is net profit important?

It helps you understand your economic health, plan your budget, impress investors, and improve your judgment in the establishment.