Cash Chahiye!

Swipe Kariye,

Loan Payiye

Loan Payiye

Get approved for Instant Personal funds up to ₹1,00,000 in just 2 mins...

Loan upto ₹5 Cr

Low Interest Rates

100% Online Process

Multiple Loans

EMI Calculator

₹

67,000

1K

2L

4L

6L

8L

10L

12

%

0

5

10

15

20

25

28.5

6

Mo

Yr

6

12

24

36

48

60

Principal (A)

₹67,000

Interest (B)

₹2,360

About SwipeLoan

Get Insta Personal Loans in India with Swipe Loan – Fast, Easy & 100% Online

At SwipeLoan, we believe in simplifying and revolutionizing the way you access financial solutions. Through our cutting-edge digital app, we're dedicated to providing seamless, accessible, and transparent lending experiences to empower your financial journey.

Subscribers

0

M+

Lending Partners

0

+

Loan Disbursements

0

K+

Why choose

SwipeLoan

Lower Interest Rates

Get loans for multiple purposes at lower interest rates to suit your needs

Fast Processing & Disbursal

Apply online, check your eligibility and get money directly in your bank in 2 minutes

Easy Repayment Options

Repay the loan amount in easy EMI with flexible tenure options

100% Paperless

No paperwork or physical documentation is required, and you can apply and get a loan completely online.

Safe, Secure and Transparent

Our loan application process is fully secured and safe and there are no hidden

charges.

Collateral Free

No collateral is required to apply for our loans.

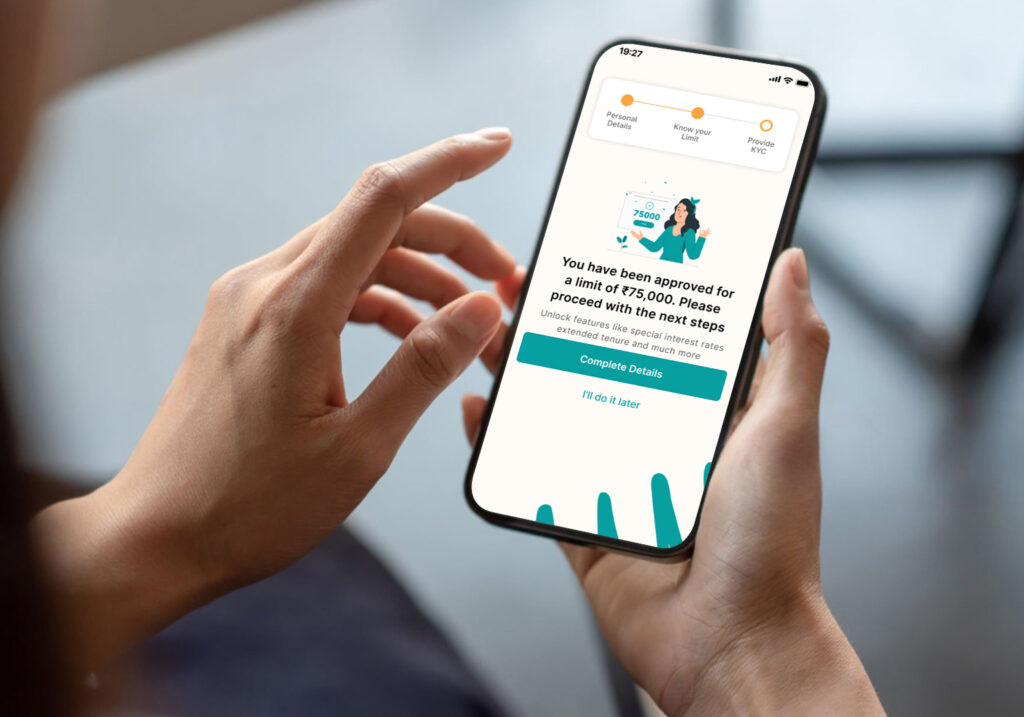

How It Works

Start your credit approval

Online Application

Complete our quick and secure online application form.

Instant Decision

Receive an instant decision on your loan

application.

Quick Disbursal

Upon approval, get funds disbursed swiftly into your account.

Testimonials

What Our Clients Say

"SwipeLoan helped me consolidate my business debts into one manageable loan. This allowed me to focus on growing my company without the stress of multiple payments. I highly recommend them for any entrepreneur looking for a financial solution."

Sarah M.

Teacher

"SwipeLoan's online application was so convenient, especially during my busy work schedule. I was able to get the funds I needed to cover my daughter's school fees quickly and easily. Thank you, SwipeLoan!"

Rani P.

Doctor

"Thanks to SwipeLoan, I was able to afford the extra coaching I needed to ace my entrance exams. Their fast approval process and flexible repayment options made it a stress-free experience. I'm on my way to my dream college now!"

Priya K.

Student